iowa inheritance tax rates 2020

It has an inheritance tax with a top tax rate of 18. For decedents dying on or after January 1 202 but before January 1 2022 the 3applicable tax rates listed in Iowa Code section 450101-4 are reduced by 40.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Each marginal rate only applies to earnings within the.

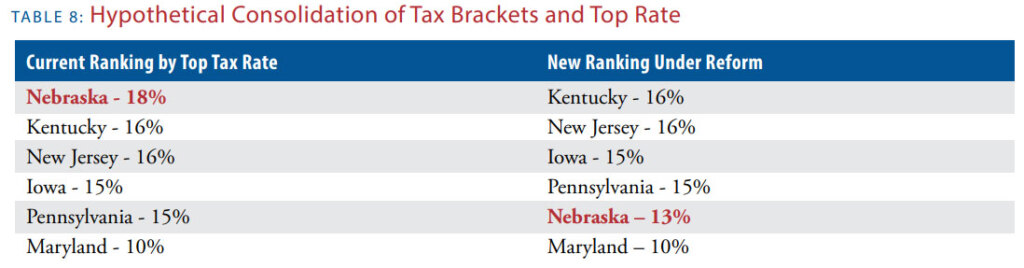

. That is worse than Iowas top inheritance tax rate of 15. Inheritance Tax Rates Schedule. When the property or any interest in property or income from property taxable under this chapter passes to any firm corporation or society organized for profit including fraternal and social.

That is worse than Iowas top inheritance tax rate of 15. Change or Cancel a Permit. Iowa Inheritance Tax Rates.

This is for siblings half-siblings and children-in-law. 2021 60-062 Print IA 8864 Biodiesel Blended Fuel Tax Credit 41-149 Read moreabout IA 8864. Spouse to tax in the donor-grantors estate in the same manner as if the tax had been deferredundersections45044through45049.

A summary of the different categories is as follows. The Iowa inheritance tax rate varies depending on the relationship of the inheritors to the deceased person. Especially if your total assets approach 5 million or more the possibility of being subject to estate tax rates as high as 40 percent can be a compelling reason to consider land protection.

12501-25000 has an Iowa inheritance tax rate of 6. How much is the inheritance tax in Iowa. That is worse than Iowas top inheritance tax rate of 15.

Tax Rate B. Bracket Tax Is This Amount Plus This Percentage Of the Amount Over 0 to 2600 0 plus 10 0 2600 to 9450 260 plus 24 2600 9450. When the net estate of the decedent is less than 25000.

The applicable tax rates. The exemption level is. 25001-75500 has an Iowa inheritance tax rate of 7.

The rate ranges from 5 to 10 based on the size of the inheritance. In 2013 the Indiana legislature repealed their inheritance tax completely. What is the inheritance tax 2020.

It has an inheritance tax with a top tax rate of 18. Iowa has nine marginal tax brackets ranging from 033 the lowest Iowa tax bracket to 853 the highest Iowa tax bracket. In short no Iowa inheritance tax is due under the following circumstances.

Iowa Inheritance Tax Rates. This is for uncles aunts. A bigger difference between the two states is how the exemptions to the tax work.

2021 taxiowagov 60-062 01032022 Pursuant to Iowa Code chapter 450 the tax rates are as follows. Inheritance Tax Rates Schedule. The Tax Cuts and Jobs Act TCJA doubled the estate tax exemption to 1118 million for singles and 2236 million for married couples but only for 2018 through 2025.

ESTATEGIFT TAX RATE SCHEDULE. How do I avoid inheritance tax in Iowa. Register for a Permit.

It has an inheritance tax with a top tax rate of 18. Track or File Rent Reimbursement. If the net estate of the decedent found on line 5 of IA.

How much is the inheritance tax in Iowa. Pursuant to the bill for persons dying in the year 2021 the Iowa inheritance tax will be reduced by twenty. 2021 60-062 Read moreabout Inheritance Tax Rates Schedule.

75001-100000 has an Iowa inheritance tax rate of 8.

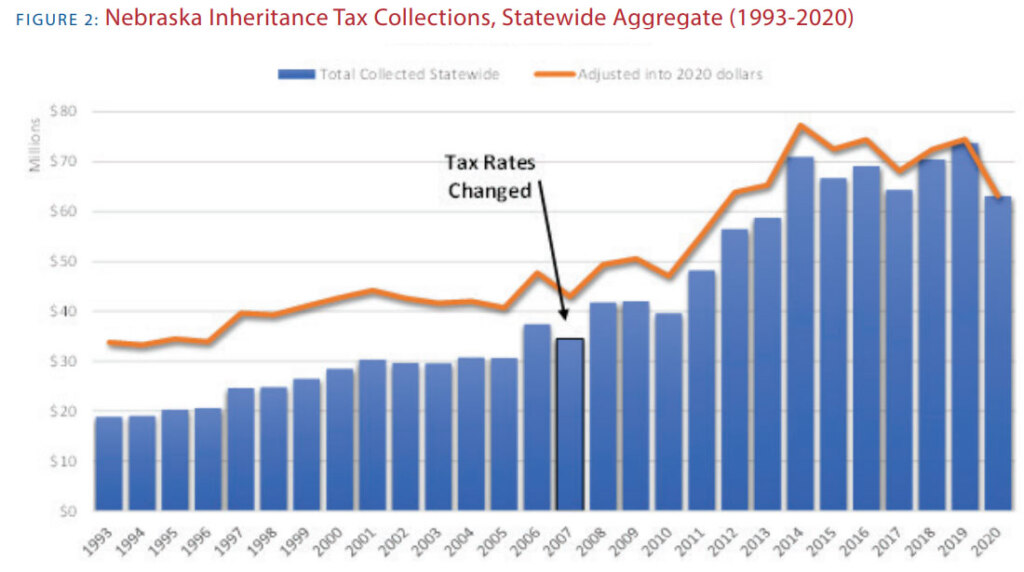

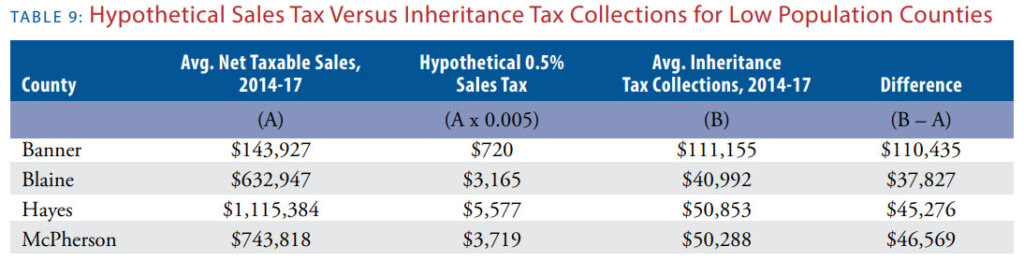

Death And Taxes Nebraska S Inheritance Tax

Death And Taxes Nebraska S Inheritance Tax

Death And Taxes Nebraska S Inheritance Tax

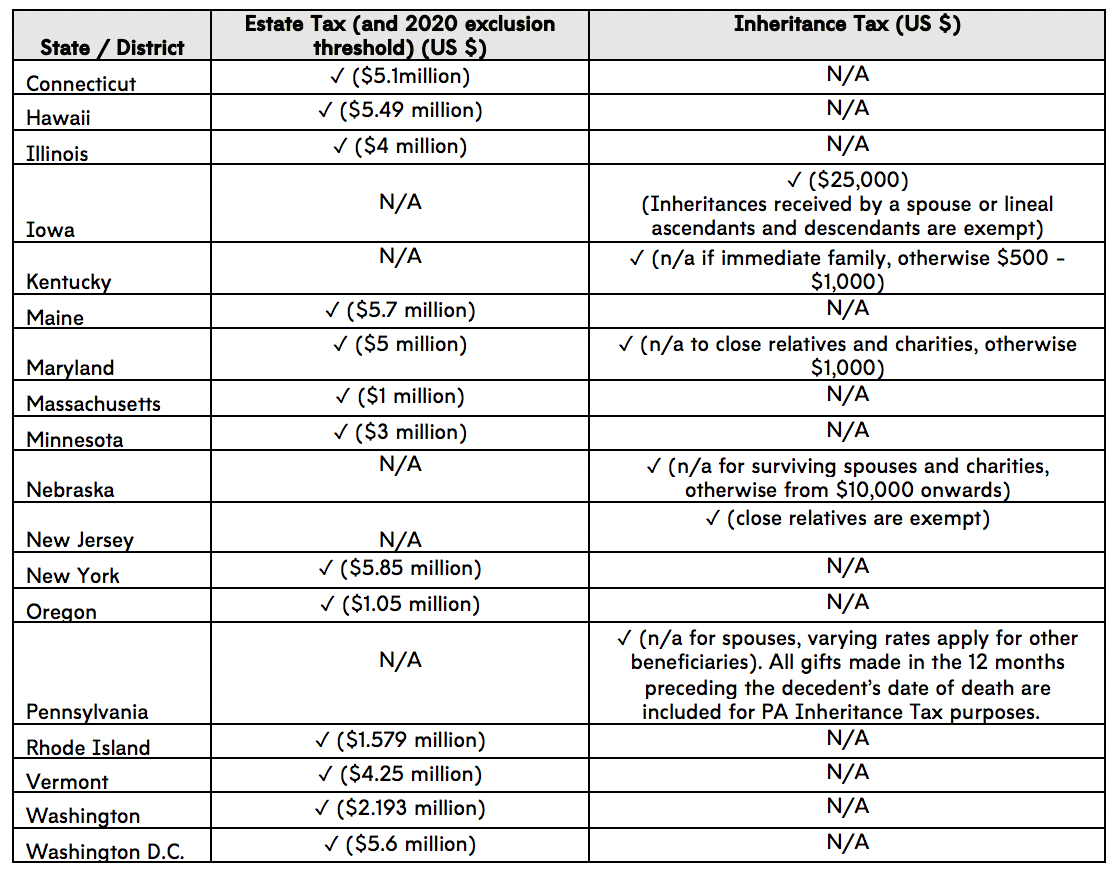

States With Estate And Inheritance Taxes

A Guide To The Federal Estate Tax For 2022 And 2023 Smartasset

Iowa Lawmakers Pass Massive Tax Cut Iowa Capital Dispatch

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

A Guide To The Federal Estate Tax For 2022 And 2023 Smartasset

Corporate Income Taxes Urban Institute

U S States Imposing Estate And Inheritance Taxes Asena Advisors

Estate Tax Rates Forms For 2022 State By State Table

What Is Inheritance Tax Probate Advance

Death And Taxes Nebraska S Inheritance Tax

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Iowa Inheritance Tax Rate Schedule Fill Out Sign Online Dochub